Introduction: Tax season can be a daunting time for small business owners, with the looming deadline and the myriad of paperwork to navigate. But fear not! With the right strategies and tools in place, you can breeze through tax season with ease and keep your sanity intact. In this comprehensive guide, we’ll delve into everything you need to know to tackle tax season like a pro.

Section 1: Understanding Tax Season Tax season typically refers to the period between January and April when individuals and businesses are required to file their income tax returns with the government. For small business owners, tax season can be particularly challenging, as they must navigate complex tax laws and regulations while also managing the day-to-day operations of their business. It’s essential to understand the key deadlines and requirements associated with tax season to avoid penalties and ensure compliance.

Section 2: The Importance of Early Preparation One of the best ways to alleviate the stress of tax season is to start early. Don’t wait until the last minute to gather your documents and receipts. Begin organizing your financial records well in advance, allowing yourself ample time to review and prepare. By starting early, you can avoid the rush and ensure that you have everything you need to file your taxes accurately and on time.

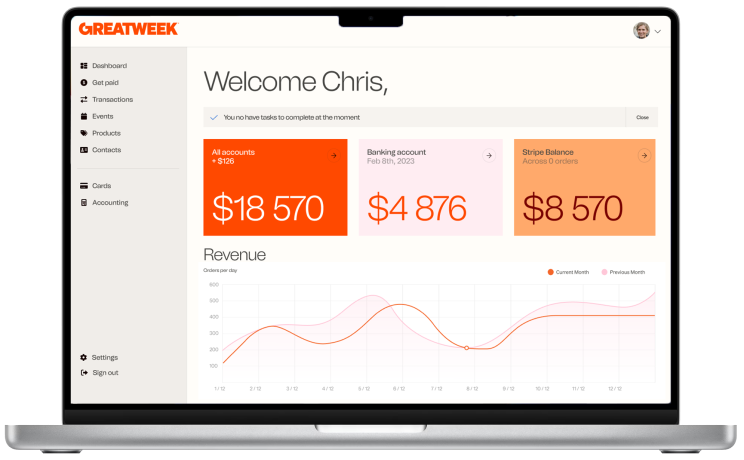

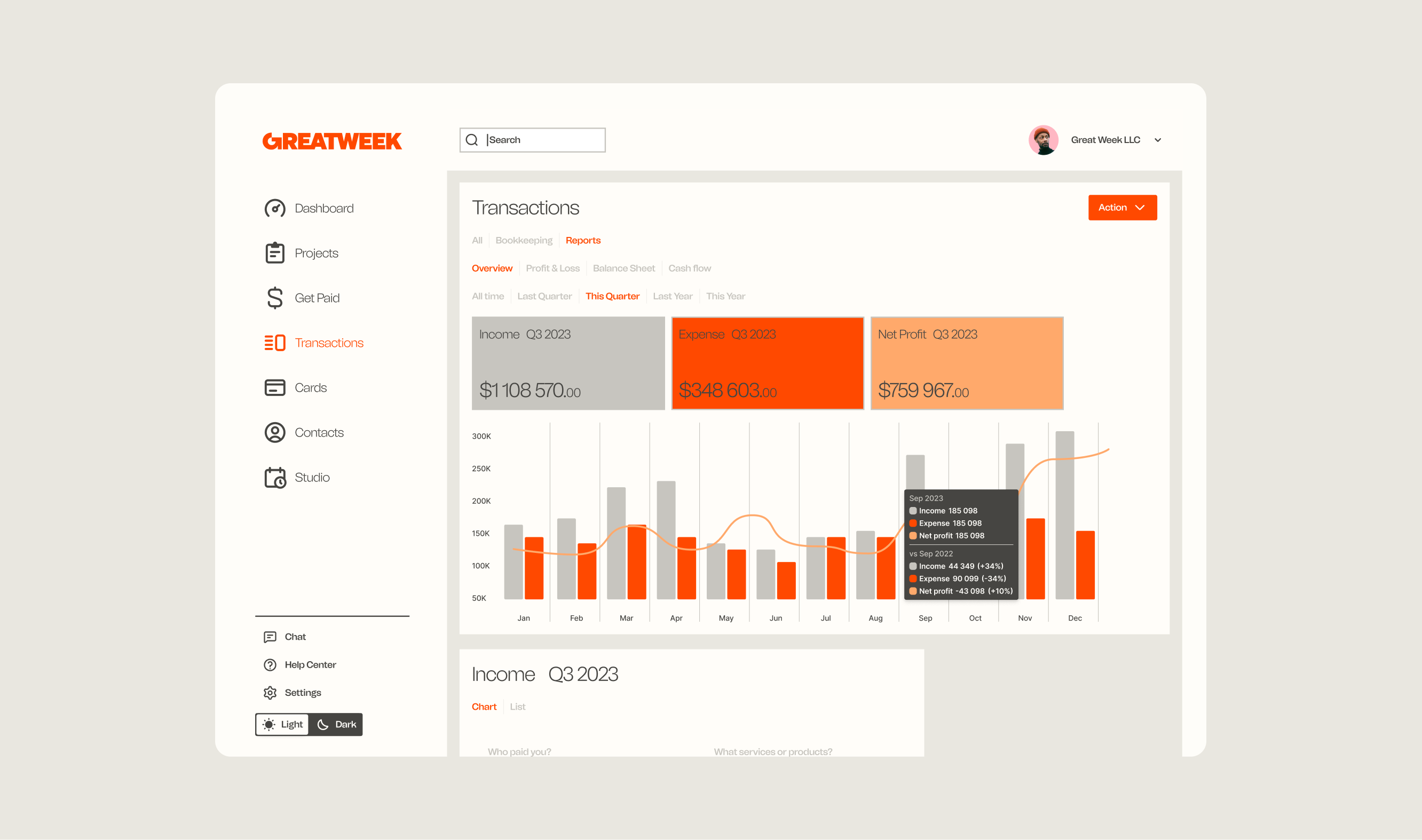

Section 3: Getting Organized Organization is key to a smooth tax season. Implement a system for tracking expenses, invoices, and receipts throughout the year. Consider using accounting software like Greatweek, which offers features specifically designed to streamline financial record-keeping and simplify tax preparation. By keeping your financial records organized, you’ll be better prepared to file your taxes and identify potential deductions and credits that can save you money.

Section 4: Maximizing Deductions and Credits Take advantage of every deduction and credit available to you. Keep track of business expenses, including office supplies, travel, and equipment purchases. Don’t overlook deductions for home office expenses if you work from home. Additionally, be sure to explore tax credits that may be available to small business owners, such as the Small Business Health Care Tax Credit or the Research and Development Tax Credit. By maximizing your deductions and credits, you can reduce your tax liability and keep more money in your pocket.

Section 5: Staying Informed Tax laws and regulations are constantly changing, so it’s essential to stay informed. Keep up-to-date with the latest tax updates and changes that may impact your business. Consider consulting with a tax professional to ensure compliance and maximize your tax savings. Additionally, take advantage of resources available online, such as the IRS website or tax preparation software, to stay informed about important tax deadlines and requirements.

Section 6: Leveraging Technology Technology can be a game-changer when it comes to managing taxes. Greatweek’s AI-powered features can automate tedious tasks like expense tracking, categorization, and receipt scanning, saving you valuable time and minimizing errors. By leveraging technology, you can streamline the tax preparation process and focus your time and energy on growing your business.

Section 7: Planning for Next Year Don’t wait until tax season rolls around to start preparing for next year. Use this time to implement systems and processes that will make tax preparation easier in the future. Set aside time each month to review your finances and stay organized year-round. By staying proactive and planning ahead, you can avoid the stress and last-minute scrambling that often accompanies tax season.

Conclusion: By following these tips and leveraging the right tools, you can navigate tax season with confidence and peace of mind. With Greatweek’s features at your fingertips, you’ll be well-equipped to tackle tax season efficiently and keep your focus where it belongs—on growing your business. Say goodbye to tax season stress and hello to financial success!