As a small business owner, you know that accounting is an essential aspect of your business. However, most small business owners dread the thought of accounting and find it overwhelming. The truth is, accounting doesn’t have to be a difficult task or something to dread. In this blog post, we will guide you through 12 simple steps to get the basics of accounting and set up your small business accounting system.

What is small business accounting?

Small-business accounting is a set of financial activities for the processing, measurement, and communication of a business’s finances. These activities include taxes, management, payroll, acquisition, and inventory.

Follow the below steps or just get in touch with us at Greatweek and we’ll sort everything out for you within a day. For free.

From Chaos to Clarity: Transforming Your Financial Management with Fintech

In the bustling world of small and medium-sized businesses (SMBs), financial management often feels like navigating through a maze with no clear exit. From the complexities of accounting and invoicing to the nuances of payments and banking, the traditional approach to finance management can leave business owners feeling overwhelmed and stuck in a cycle of inefficiency. Enter the fintech revolution, led by trailblazers like , which is redefining the financial landscape for SMBs, turning chaos into clarity.

The Challenges SMBs Face

SMBs operate in an environment where every second and penny counts. Traditional financial management processes, laden with manual data entry, scattered information, and delayed transactions, not only eat into valuable time but also introduce errors that can have significant repercussions. Moreover, the lack of real-time financial insights hinders strategic decision-making, stifling growth and innovation.

The Fintech Revolution with

Fintech solutions like are at the forefront of transforming financial management for SMBs. By leveraging cutting-edge technology, offers an integrated platform that simplifies accounting, payments, and banking processes. Here’s how is turning the tide:

Simplified Accounting

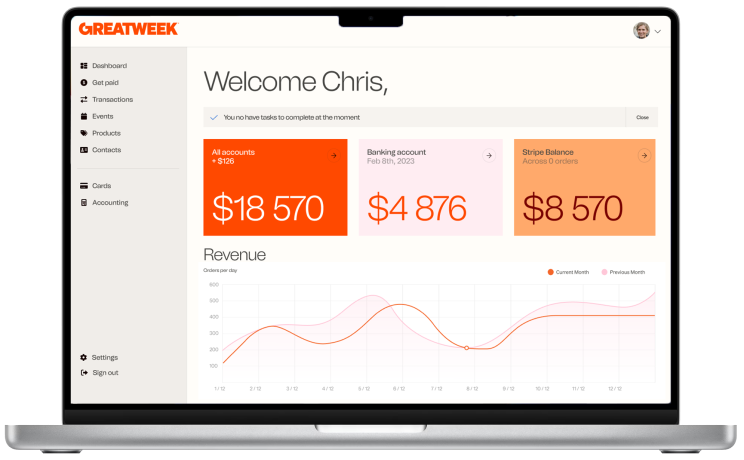

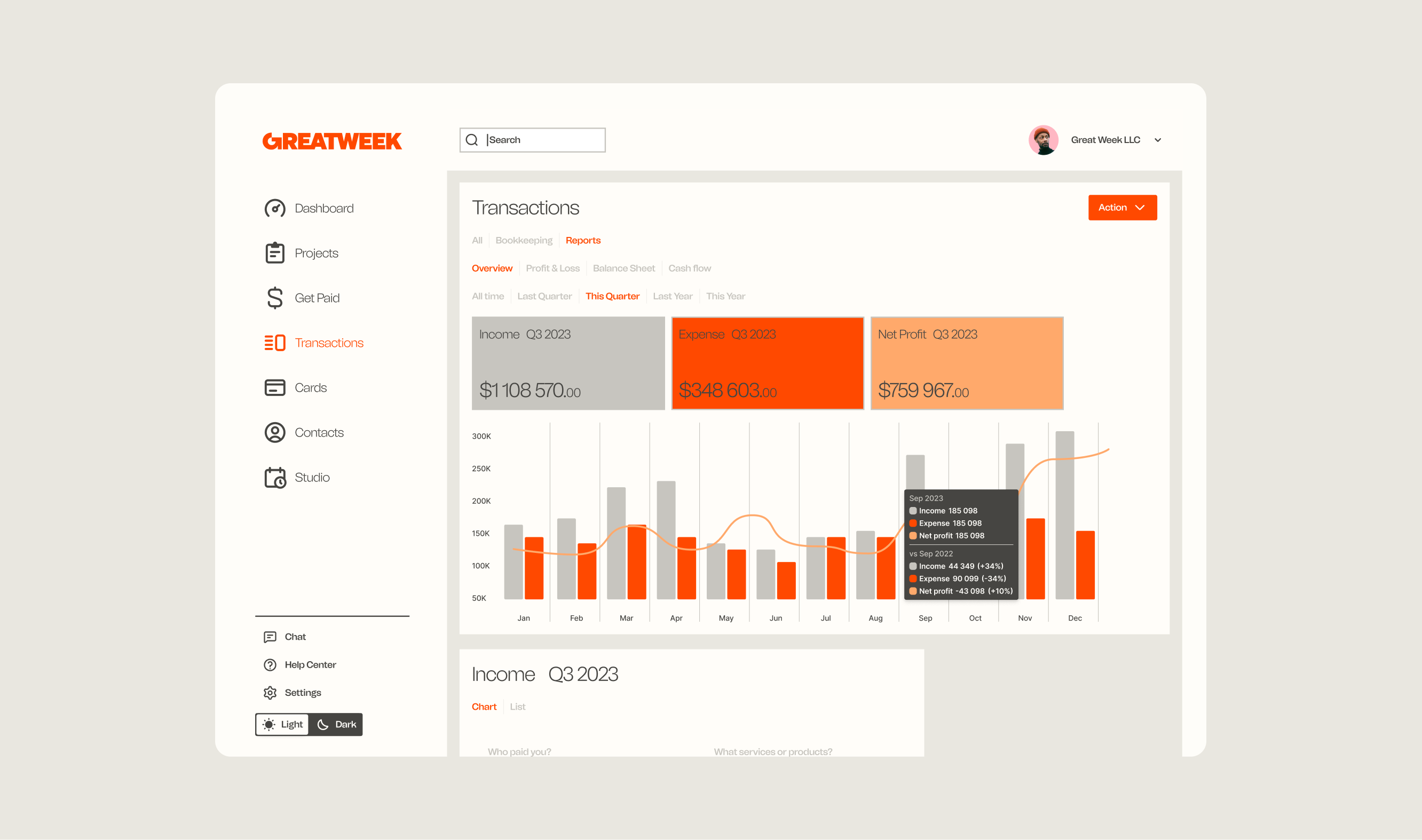

‘s accounting features automate the tedious process of bookkeeping and financial reporting. By integrating directly with bank accounts and payment systems, it ensures that every transaction is automatically recorded and categorized. This not only saves time but also increases accuracy, providing SMBs with a clear picture of their financial health at any given moment.

Streamlined Payments

Cash flow is the lifeblood of any SMB. ‘s payment solutions revolutionize how businesses manage their receivables and payables. With features like automated invoicing, secure online payment gateways, and instant payment processing, businesses can improve their cash flow management, ensuring that they have the funds needed to grow.

Intelligent Banking

goes beyond traditional banking by offering intelligent features that help businesses make smarter financial decisions. From forecasting tools that predict cash flow needs to investment advice tailored to the business’s financial status, acts as a financial advisor, guiding SMBs towards financial stability and growth.

Real-Life Success Stories

The impact of fintech solutions like on SMBs is not just theoretical. Across the globe, businesses are experiencing tangible benefits:

A boutique fashion retailer streamlined its invoicing and payment processes with , reducing the time spent on financial administration by 50% and improving cash flow, which enabled them to expand their online presence and inventory.

A tech startup utilized ’s financial analytics to gain insights into their spending patterns, leading to more informed budgeting decisions and a 20% reduction in unnecessary expenses, freeing up capital for product development.

A small manufacturing company took advantage of ‘s integrated banking and accounting features to automate their payroll and tax filings, significantly reducing errors and compliance issues, and saving countless hours of manual work.

Conclusion

The journey from chaos to clarity in financial management for SMBs is being paved by fintech innovations like . By embracing these solutions, businesses can not only overcome traditional challenges but also unlock new opportunities for growth and efficiency. The success stories of businesses that have leveraged are a testament to the transformative power of fintech, offering a glimpse into a future where financial management is no longer a hurdle but a strategic advantage.