As a small business owner, you know that accounting is an essential aspect of your business. However, most small business owners dread the thought of accounting and find it overwhelming. The truth is, accounting doesn’t have to be a difficult task or something to dread. In this blog post, we will guide you through 12 simple steps to get the basics of accounting and set up your small business accounting system.

What is small business accounting?

Small-business accounting is a set of financial activities for the processing, measurement, and communication of a business’s finances. These activities include taxes, management, payroll, acquisition, and inventory.

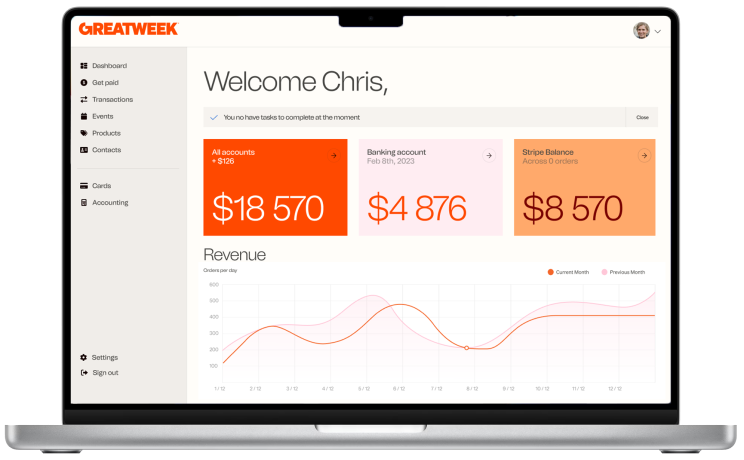

Follow the below steps or just get in touch with us at Greatweek and we’ll sort everything out for you within a day. For free.

1. Choose an Accounting Method

The first step in accounting for small businesses is to choose an accounting method. There are two types of accounting methods; the cash method and the accrual method. The cash method records revenue and expenses when cash changes hands while the accrual method records revenue and expenses when they occur instead of when cash changes hands.

2. Create a Chart of Accounts structure

The chart of accounts is a list of all the accounts in your accounting system. These accounts are used to categorize the financial transactions of your business. You can create a chart of accounts using accounting software like www.greatweek.com or a simple spreadsheet. Your chart of accounts should include all your income, expenses, assets, liabilities, and equity accounts.

3. Automate your Bookkeeping System

A bookkeeping system is essential, especially for small businesses. It enables you to track your financial transactions accurately and efficiently. You can create a bookkeeping system using accounting software that’s suitable for your business. This system helps you organize your financial transactions, invoices, and payments, making accounting much easier. At Greatweek we have implemented AI to learn your transaction categories to help you save time.

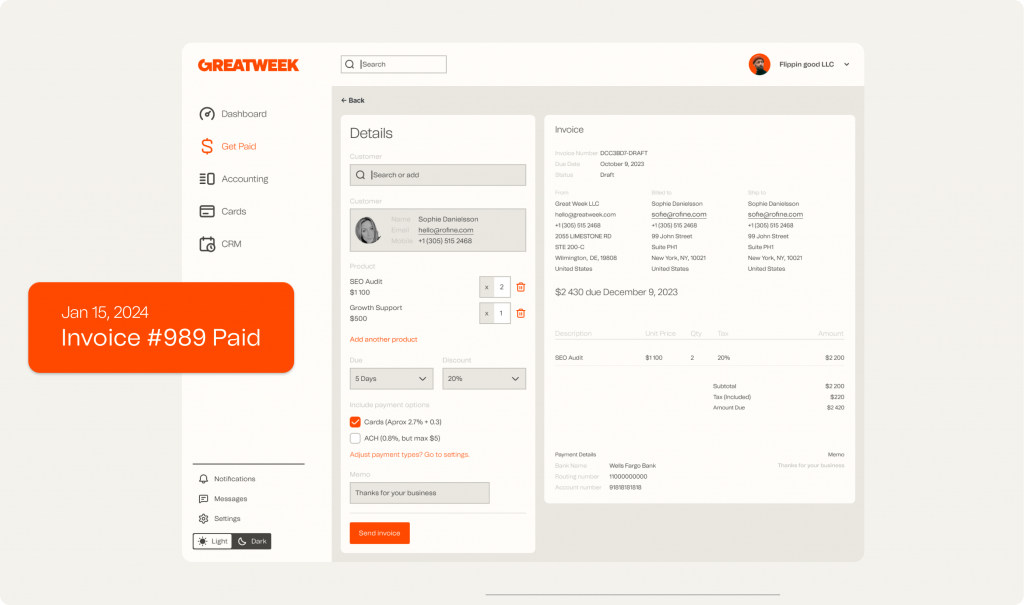

4. Create Invoices

Invoicing is the process of billing customers for goods or services provided. You need to create invoices that meet legal requirements, including sales tax, payment due date, and your business information. Using invoicing software, you can generate professional invoices quickly and easily.

5. Track Expenses

Keeping track of expenses is critical for monitoring your cash flow and designating deductions and amortizations when filing taxes. You should record every expense, including small purchases. With the Greatweek iOS or Android app you can take pictures of your receipts on the go. Everything is synced with your bookkeeping.

6. Reconcile Bank Statements

Reconciling your bank statements is essential to ensure that all your transactions have been recorded correctly in your accounting system. You should evaluate your bank transactions against your accounting records at least once a month. This helps identify discrepancies before they become critical errors.

7. Determine Tax Obligations

Small businesses have tax obligations required by the federal government and the state they reside in. This includes income taxes, payroll taxes, and sales taxes. You need to research your tax obligations carefully to ensure you meet the required deadlines and avoid penalties.

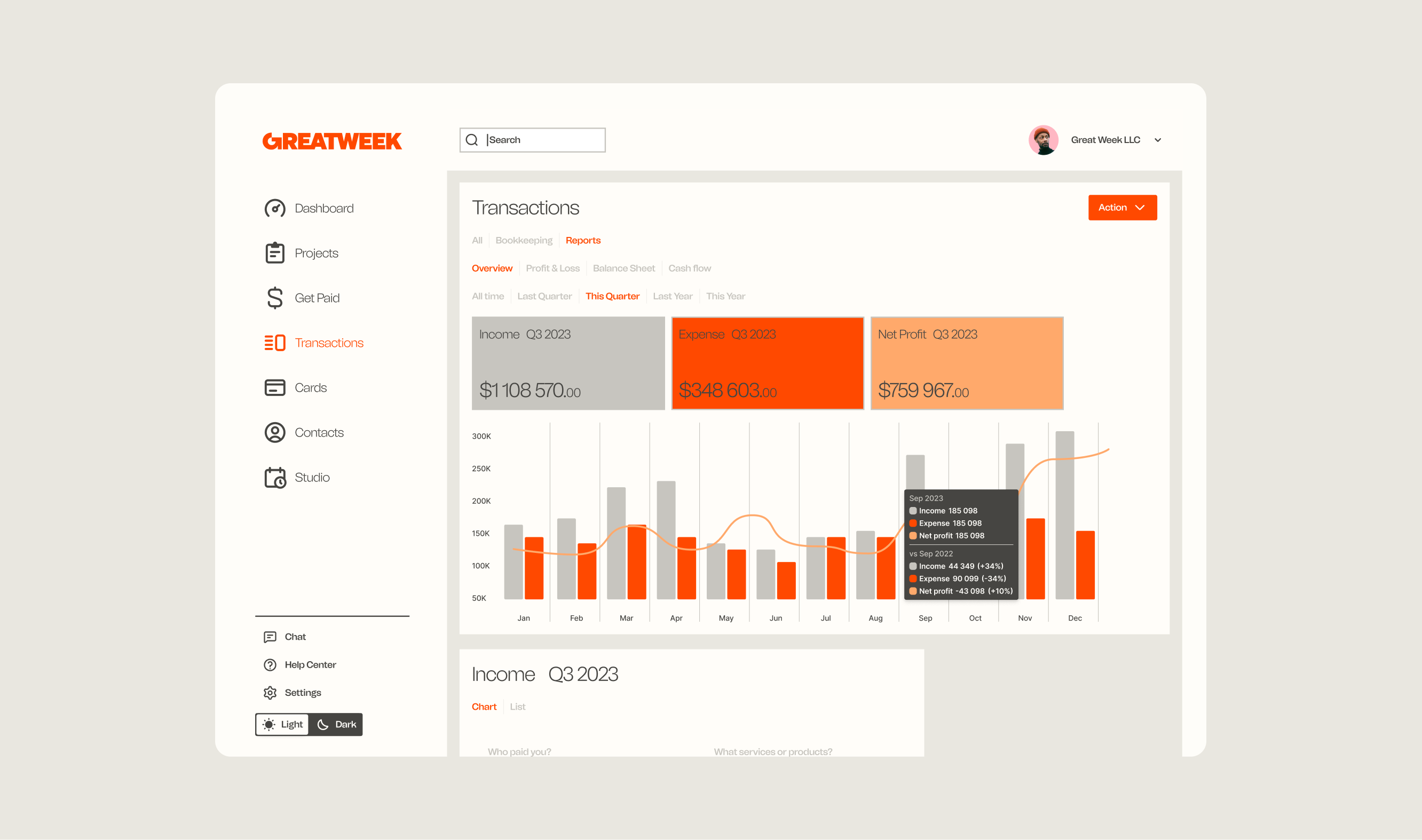

8. Prepare Financial Statements

Financial statements provide an overview of your business’s financial health and are essential for decision-making. You should prepare financial statements, including balance sheets, income statements, and cash flow statements, at least once a year. All these reports are available for free at Greatweek.com

9. Consult an Accountant or CPA

Lastly, you may want to consult an accountant, especially when taxes are concerned. An accountant can help you understand your tax obligations, mitigate risks, and identify opportunities for growth.

One of our in-house CPA can help submit all your annual reports and suggest tax optimization efforts.

Conclusion:

Setting up a robust accounting system for your small business is crucial to understand the financial state, make informed decisions, and perform necessary actions that help your business grow financially. Fortunately, accounting doesn’t have to be difficult or intimidating. By following the 9 steps outlined above, you can get your accounting basics in order and set up a sound accounting system that effectively meets your business requirements.