Many small business owners operate as sole proprietors, which is great for some, but in many cases, it’s better to run a business as a company. Mainly it depends on the business model and of course the turnover. In this article, we talk about when it’s better to stay as a sole proprietor and when it’s better to shift to a company.

Many small business owners operate as sole proprietors, which is great for some, but in many cases, it’s better to run a business as a company. Mainly it depends on the business model and of course the turnover. In this article, we talk about when it’s better to stay as a sole proprietor and when it’s better to shift to a company.

Sole Proprietorship vs Company

The main difference between a sole proprietorship and a limited liability company (LLC) is that whereas one has unlimited liability (meaning your assets can be used to pay off debts incurred by your business), the other limits your liability through incorporation.

What is Sole Proprietorship?

A sole proprietorship is an unincorporated business owned by one individual. It doesn’t have its own legal status as a separate entity from its owner, so all profits are taxed on your personal income tax return. You’re personally liable for any debts or claims against your business — if you don’t pay them, then they may come after your personal assets such as bank accounts, home, and car.

So how do I know whats best for me?

The first thing to consider when deciding whether you should operate as a company or sole proprietor is the nature of your business. If you’re in a service-based industry, for example, then it’s usually better to operate as a company.

If you’re selling products, this can be more tricky to assess. For instance, if your turnover is relatively low and you don’t have any employees, then it might not make sense to shift from sole proprietorship to company status.

On the other hand, if your business has high annual sales and employs people, then it’s worth considering registering as a limited liability company (LLC). This will protect your personal assets from claims against the business, should things go wrong.

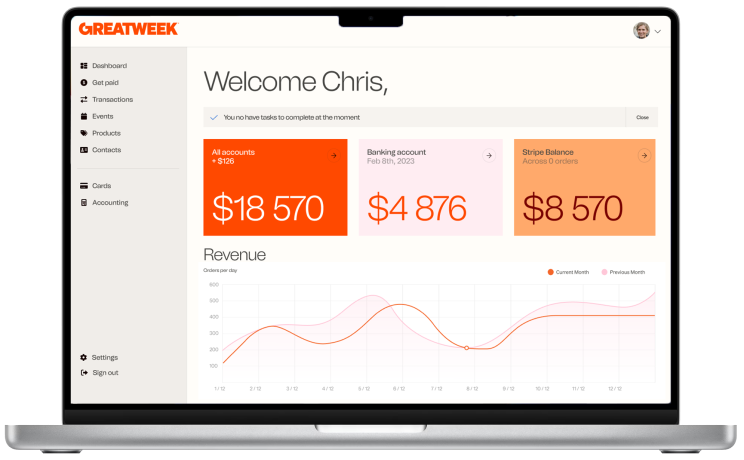

At Greatweek, we work with both Sole Proprietors and Companies. We have highly experienced advisors, both business and tax specialists, that can help you choose. Feel free to reach out to us and get a free consultation on whats right, specifically for your business.