Small business owners are always looking for ways to save time and money. One of the best ways to do this is by using financial apps. These are programs that allow you to manage your finances from your phone or computer, so you don’t have to go into the office every day.

There are hundreds of different financial apps available, but here are three that we think are worth checking out:

1) PocketGuard (free): This app helps you track your spending and income automatically. It also lets you set budgets and alerts so that you don’t spend too much money on something like lunch or gas.

2) Mint (free): This app is great if your business has multiple bank accounts because it will help you keep track of all of them in one place. It also makes it easy for clients to pay their bills online through their credit card or bank account information—which saves time on both sides!

3) QuickBooks Self-Employed ($9/month): If your small business has more than one employee (or even just one), then this app will be perfect for tracking all of your expenses and income tax payments—as well as helping employees with their own taxes!

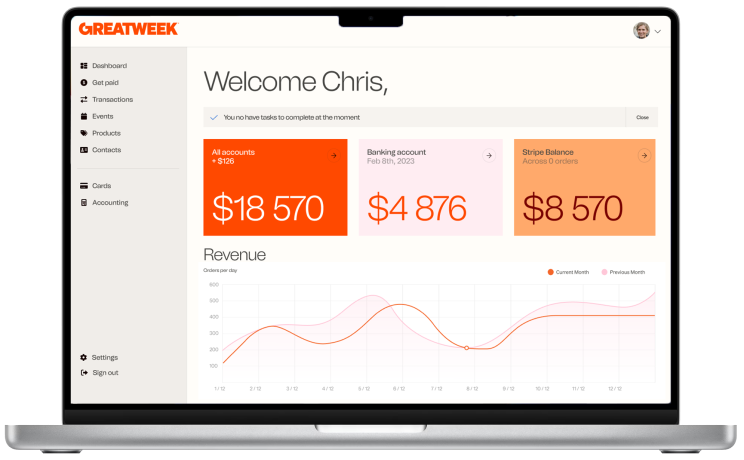

4) Great Week (Free): This is a new entrant, that takes a different approach from the existing accounting software. Great Week is an all in one platform that allows you to have everything in one place, including Banking, Payments, CRM, and accounting.

Why keep track of income and expenses as a small business owner

As a small business owner, you probably don’t want to spend your time on accounting. You have plenty of other things to do! But if you want to be successful and grow your business, it’s important to keep track of the numbers.

In this post we’ll look at why keeping track of income and expenses is so important for small businesses. We’ll also show you how you can use [product name] to do this quickly, easily, and painlessly.

Track your cash flow.

When you’re running a small business, it’s important to keep track of your cash flow. You can’t grow if you don’t know where your money is going!

Fortunately, this is something we can help with. We can provide accounting services that will help you track your finances and make sure that you have all the information you need to make decisions about how best to use your money.

We can also provide bookkeeping services that will make it easier for you to manage all of the different accounts associated with running your business.