With the economy in a bad state, small business owners are struggling to stay afloat. But does it have to be this way?

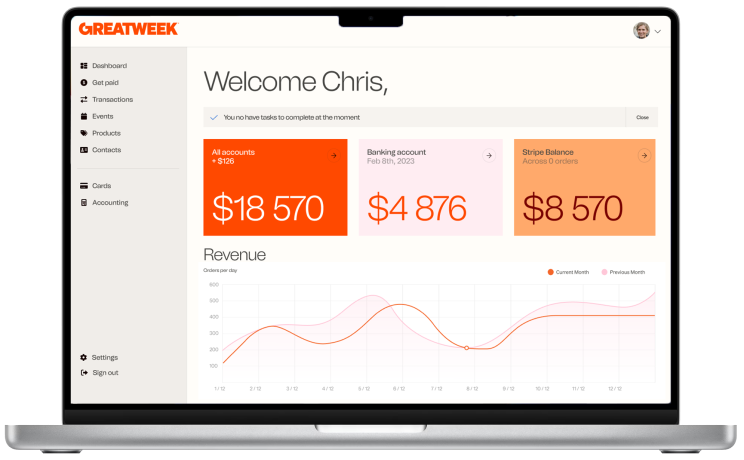

In fact, there are many ways a small business can succeed even in a bad economy. Business owners need to digitize and make use of all the latest tools available to them. From Digital Banking to automated payments, there are many things they can do today that will help their business grow and thrive.

The first step is understanding how your customers work—do they prefer online shopping or would they rather shop in your store? This is important because if you’re not offering an online option, potential customers may go elsewhere.

Once you know what your customers want, then you can figure out what kind of payment options they prefer. If they like using cash or checks instead of credit cards or debit cards, then it will be up to you as a store owner whether or not you’ll accept those forms of payment from them.

If your customers like using credit cards or debit cards more often than anything else then it’s worth considering accepting those types of payments versus others like checks or cash only for good reason such as security concerns about identity theft etc..

Small businesses are the backbone of our economy.

They’re where people go to find their first job, and where they go when they want to start something new. But it’s tough out there for small business owners these days. In this economy, it can be hard to keep your head above water.

So how do you make sure your business stays afloat? We have a few tips for you.

First off: digitize everything! From the ways, you accept payments, to the way you track inventory, to the way you book travel for employees—digitizing your business means saving money and making things easier on yourself.

Second: automate everything! You don’t want to spend hours manually entering data into spreadsheets or trying to remember which form went where when every employee leaves at 6pm on Fridays (all right, maybe that last one is just me). Automation makes everything easier and faster, so why not take advantage of it?

Finally: make sure you’ve got an accountant on your team who knows what they’re doing with taxes and regulations. You don’t want any surprises when tax season comes around—and even if your accountant isn’t able to help with taxes themselves, they can still point you in