Small businesses are usually the ones that have to compete with the largest companies out there by using limited resources. They don’t need another hurdle in their path to success but yet, it’s a major one especially when most of the industries out there never stops growing and moving in a fast pace.

It’s time to get on the digital bandwagon.

That’s right, we said it!

The digitization of your business is a must-do for any small business owner. Here are 3 reasons why:

- Stay Competitive. With so many consumers going online to research, shop, and transact daily, you need to be there—and quickly. If your business isn’t digitally optimized, then you’re missing out on the opportunity to connect with potential customers 24/7.

- Save Money on Printing Costs & Paper Waste. Printing costs can add up fast and paper waste is a nightmare for any office manager who has to deal with it on a daily basis (and who wants that?!). By digitizing your documents and communications, you’ll save money on printing costs while also reducing your carbon footprint by using less paper! Yay for the environment!

- Automate Your Business Processes. Automating your business processes is one of the best ways to save time, money and reduce stress levels at work—not just for yourself but also for employees who don’t have to do repetitive tasks manually anymore! Plus it’s easier on everyone’s brain cells when things are done automatically rather than manually (because let’s face it

Manage all aspects of your business with one easy-to-use software platform. You won’t have to learn new programs or hire employees, we will manage it for you.

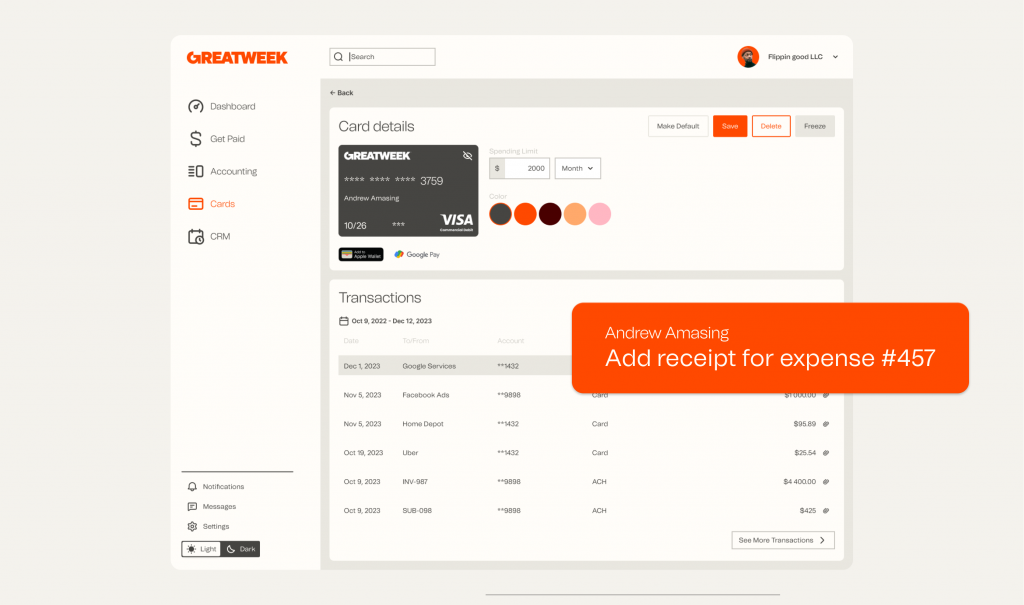

The Great Week platform is a single app that gives Business Owners the ability to manage their products, customers and employees in one location. It provides 360-degree visibility across your entire business.

Have you ever wondered how to automate your small business? Have you ever wished for a way to make sure that the same tasks are done every day, without having to think about it each time? Have you ever thought about automating a task that is so simple, that you don’t even want to do it yourself?

If any of these questions apply to you, then Greatweek is the right tool for you. Our free Banking services allows you to set up rules and parameters for your business so that no matter what happens in the real world, your business will always follow the same path. You can turn off your brain and let Greatweek handle it!