Introduction: In the dynamic landscape of business, understanding the vitality of your company is paramount for sustained success. Much like individuals undergo regular health check-ups, businesses benefit from periodic evaluations to ensure they are thriving and meeting their objectives. In this article, we delve into the concept of a business health check, exploring its components and why it is crucial for the sustained well-being of your enterprise, with a special focus on profitability and the strategic use of business apps.

What is a Business Health Check? Described by the global business advisory firm RBNC, a business health check involves a comprehensive review of your entire business operations. The goal is to identify areas for growth, cost savings, increased productivity, and enhanced profitability. Think of it as a diagnostic tool that helps you assess the overall health of your business.

What Does a Business Health Check Cover? The scope of a business health check may initially seem overwhelming, but various online resources, such as those provided by consulting firms like Appleby Consulting & Coaching, offer tailored assistance. The check typically encompasses key areas such as business strategy and planning, sales and marketing, customer relations, financial management, overall happiness within the business, profitability, and the strategic use of business apps.

- Business Strategy and Planning: Forbes draws a parallel between a business and the human brain, emphasizing the need for interconnected networks that facilitate the free flow of information, ideas, and operations. Three critical questions to consider include the alignment of your business strategy with your vision, the time required to realize your plans, and a clear projection of your business in the next 3-5 years.

- Sales and Marketing: Former CEO of Cartier International, Alain Dominique Perrin, likens sales and marketing to the air that sustains life. Questions to ponder include the growth of sales revenue and profitability over the past three years, the clarity of your unique selling proposition, the distinctiveness of your marketing strategies compared to competitors, and the strategic use of business apps to streamline sales and marketing processes.

- Customers: Valuable feedback from customers can act as a compass guiding your business in the right direction. Consider questions about identifying your ideal customers, understanding their needs, recognizing the most profitable clients, and evaluating the effectiveness of customer acquisition strategies through business apps.

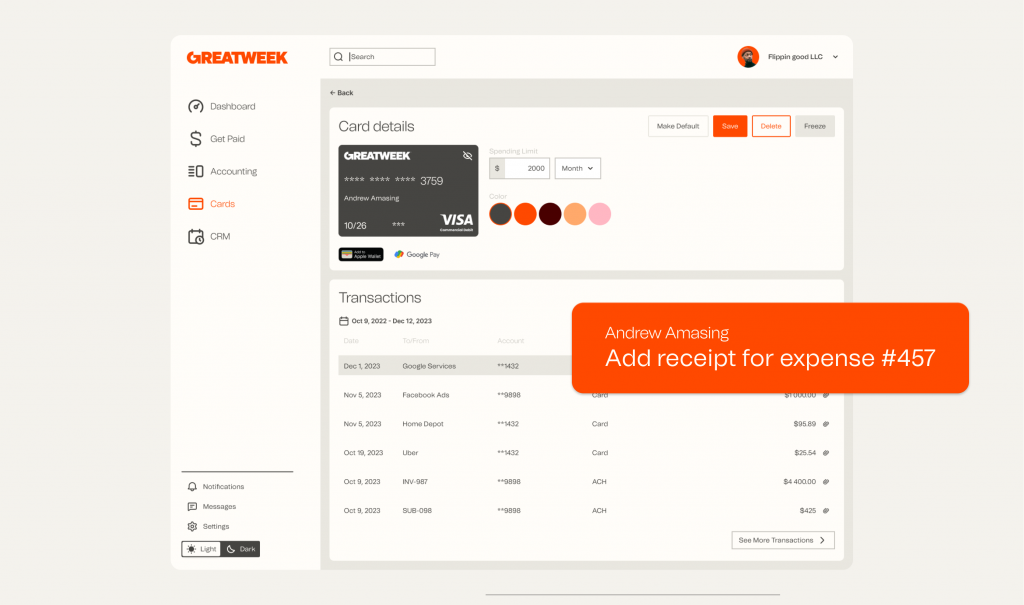

- Financial Management: As Medium points out, finance is the lifeblood of any business. To ensure financial health, assess adherence to a defined budget, the regularity of cash flow issues, the timeliness of invoice payments, and the use of financial management apps to streamline processes.

- Business Happiness: Not Just Numbers emphasizes that quality leadership, engagement, and culture form the heart of an organization. Reflect on whether your business fosters personal satisfaction and happiness, provides the necessary resources and training for your team, encourages open communication of ideas and suggestions, and leverages employee engagement apps for a positive work environment.

Profitability: An integral aspect of business health is profitability. Evaluate whether your business has experienced growth in sales revenue and profitability over the past few years, ensuring that the strategic use of business apps contributes to the overall profitability of your operations.

Strategic Use of Business Apps: In the digital age, leveraging technology is crucial. Assess whether your business utilizes apps effectively to streamline operations, enhance productivity, and improve overall efficiency. From financial management apps to CRM tools, strategic integration can significantly impact the success of your business.

Conclusion: Just as individuals invest in their health, businesses too must prioritize regular health checks. At Greatweek, we understand the importance of a healthy business for sole-traders and offer tools like free invoicing software to facilitate smooth operations. Whether you’re a sole trader or a larger enterprise, our guide encourages you to explore the many free online business health checks available, ensuring the sustained vitality, profitability, and efficient app usage of your business. For inquiries about Greatweek, online invoicing, or strategic app integration, feel free to reach out – we’re here to help you navigate the journey of entrepreneurship.