Work smarter with an all-in-one solution—manage receivables, collect payments, and reconcile transactions effortlessly.

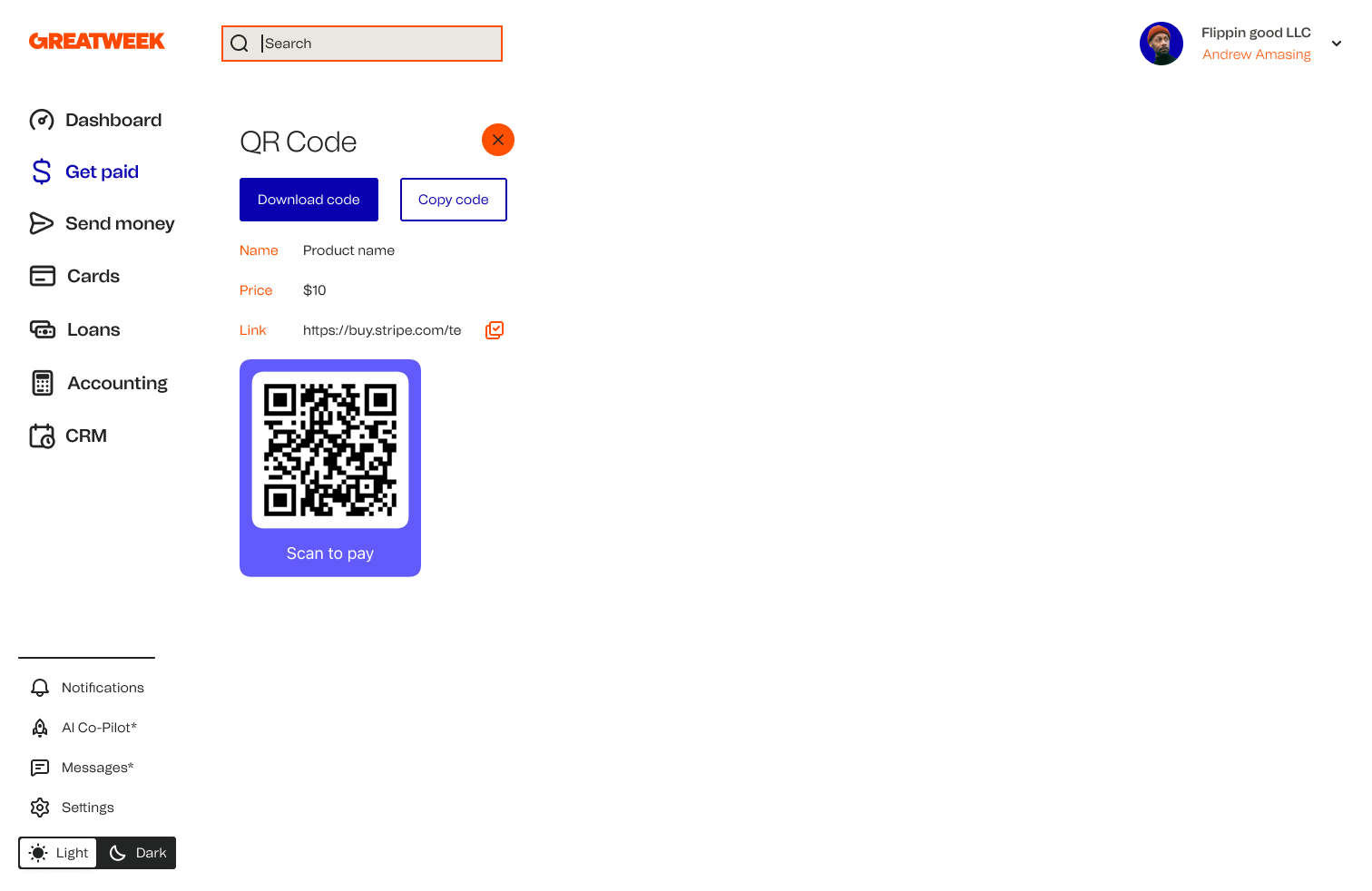

Add Payment Links or QR codes to your invoices and make paying a breeze.

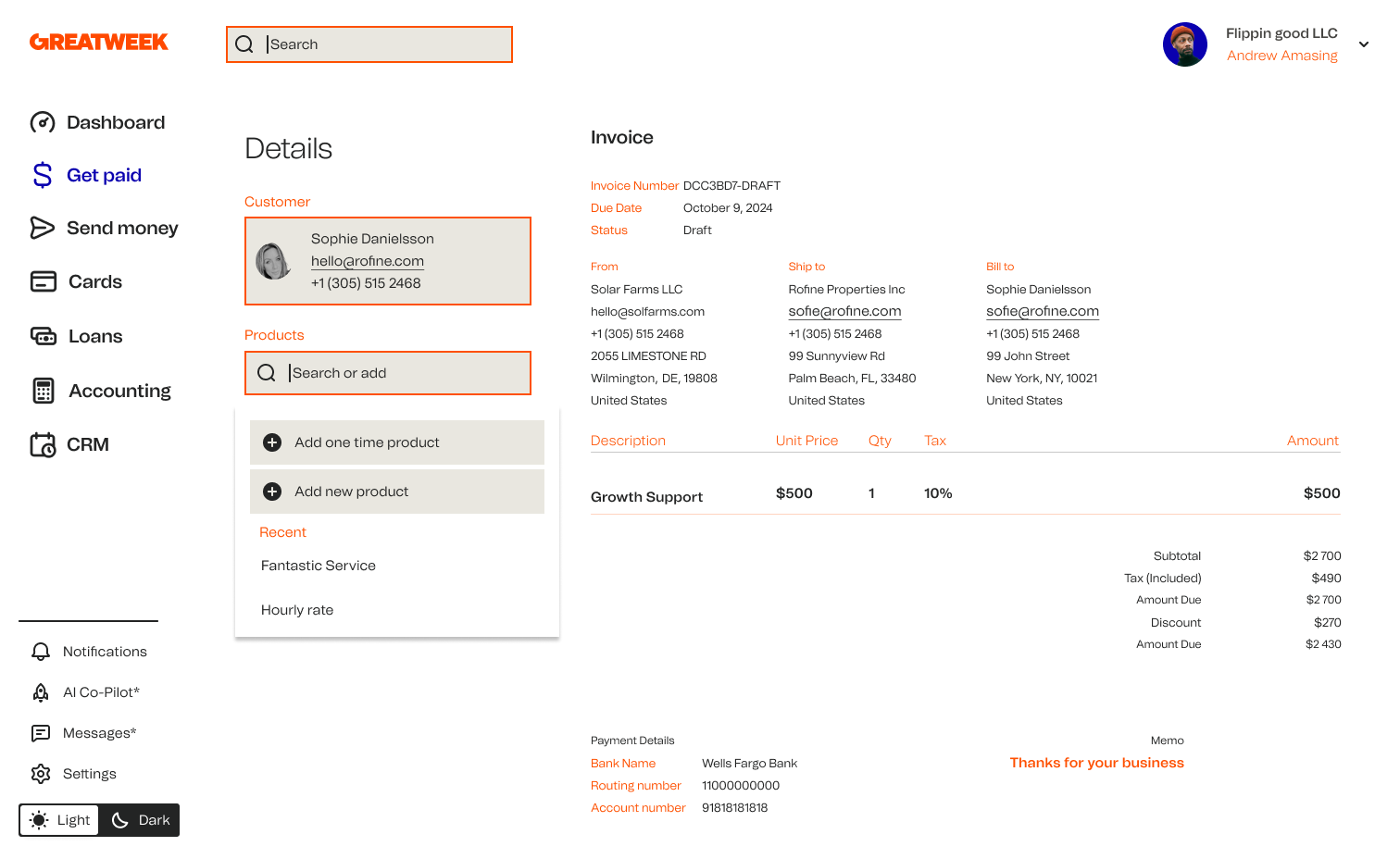

Personalise your invoices to help customers pay quickly and easily – and remember your brand.

Select from existing line items or create custom entries.

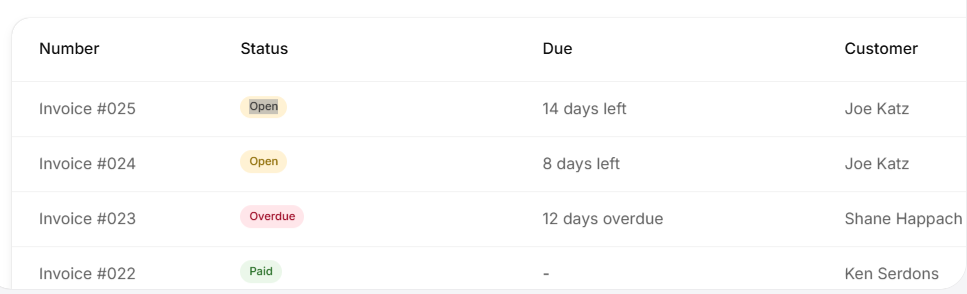

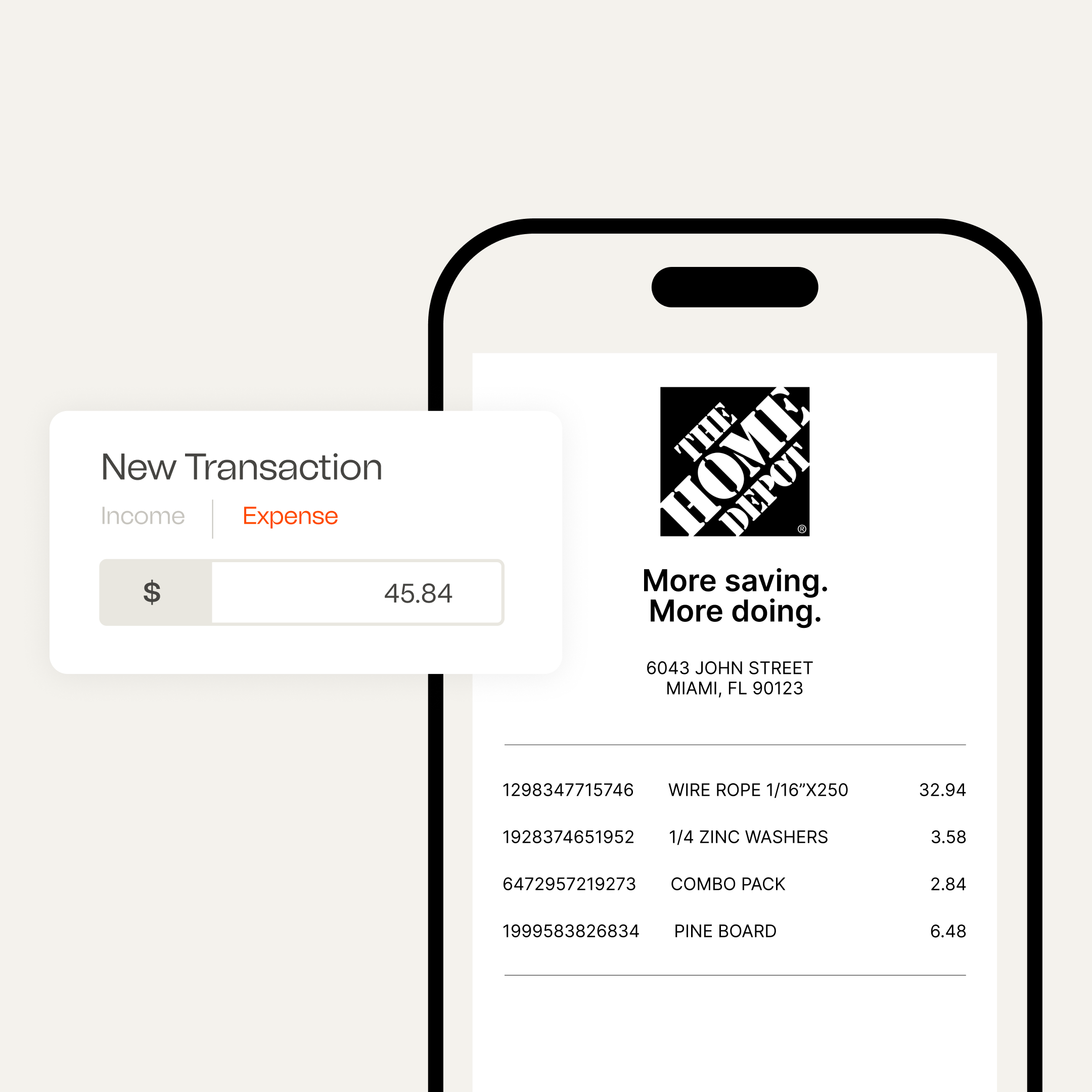

Stop manual reconciliation. Our platform helps you get paid and eliminates accounting headaches.

Set preferred payment terms or custom due dates to fit your needs – one-time billing, subscription plans, and more.

When looking for the ideal invoicing solution for your small business, it’s crucial to consider your specific needs, budgetary constraints, and personal preferences.

For small businesses with straightforward invoicing requirements, opting for a payment service provider that offers an integrated invoicing service is often the most effective method. This helps you to streamline your digital invoice creation and management and offer easy payment options – making controlling your receivables a breeze.

You can create an online invoice using various tools and software, including dedicated invoicing or payment platforms, accounting software, or even word processing and spreadsheet apps.

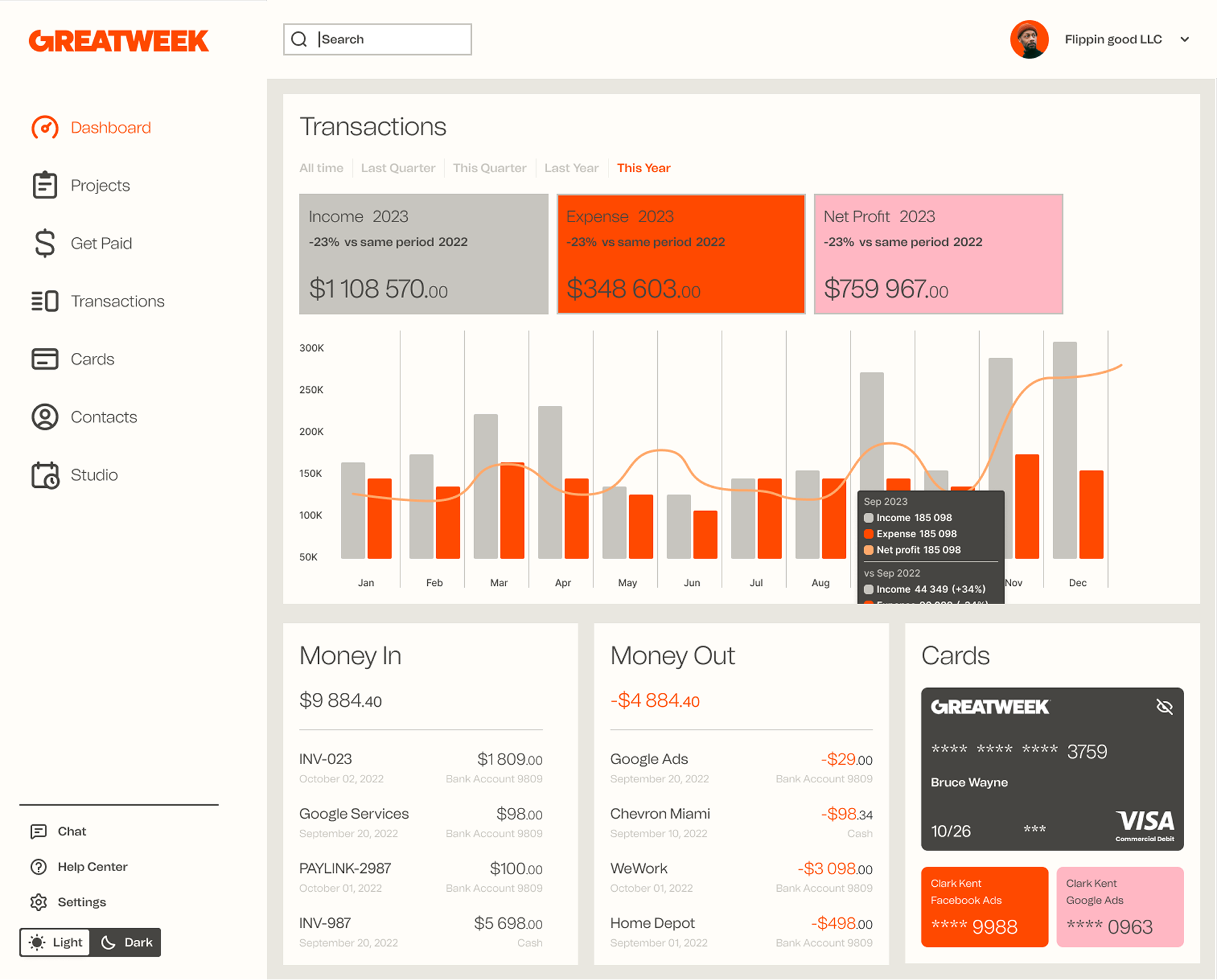

With Greatweek, you can easily create, customise, and send branded online invoices in minutes. We also provide a range of online payment options, so our all-in-one solution makes it simple to manage your receivables, collect payments, and reconcile transactions.

Greatweek Invoicing is designed to simplify and enhance your invoice management process for your business. Here’s how:

Create, customise, and send digital invoices in minutes

Faster payments with Payment Links and QR codes

Centralise all data to save time, reduce errors, and improve what you do

Set preferred payment terms or custom due dates as needed

Streamline workflows with automated tasks and recurring billing

Ultimately, it simplifies sending and managing invoices while providing an experience your customers will love.

We save your invoices for five years in alignment with data standards. You must store your invoices privately if you need to retain them beyond this timeframe.

However, the laws governing business operations differ per country. For precise guidance on VAT record-keeping, refer to the tax regulations of the country or countries in which your business operates.

Yes, Greatweek Invoicing is designed to cater to the needs of businesses of all sizes, including small and medium-sized enterprises (SMEs). Our platform offers customisable invoice management solutions to fit your specific requirements.

Greatweek is a technology provider, not a bank. Greatweek partners with Stripe Payments Company for money transmission services and account services with funds held at Evolve Bank & Trust, Member FDIC. When you sign up for a Greatweek account, you will also sign up for a Stripe Standard Connect Account. You may apply for various financial services within the platform and will need to agree to additional terms. Greatweek Visa® Commercial Credit Cards are issued by Celtic Bank. Neither Greatweek nor Stripe are FDIC-insured institutions. FDIC’s deposit insurance coverage only protects against the failure of an FDIC-insured depository institution. Stripe Treasury Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same type of account. The information provided on this website is not intended to offer, and should not be relied upon as, tax advice. You can review all our legal agreements and disclosures here.