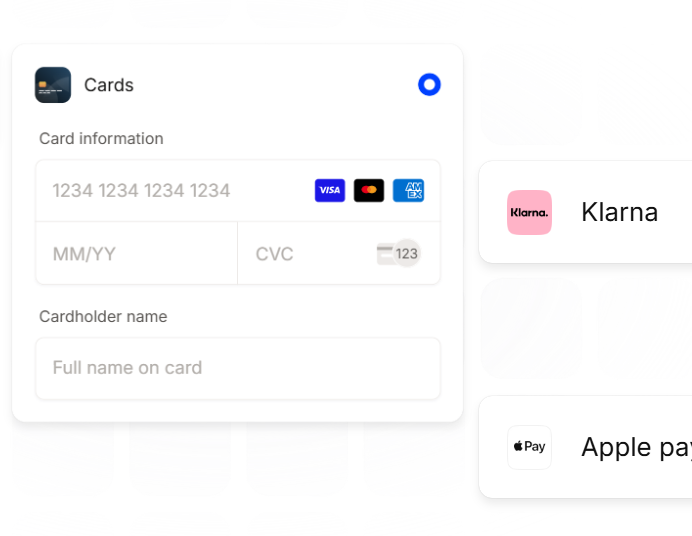

Boost conversion with optimised checkouts offering 40+ ways to pay, and drive revenue with recurring billing, invoicing, and payment links.

Convert more customers with preferred local and global payment methods – add them in one click.

We power your business as you scale: from quick, easy integration to powerful payment optimisations and effortless money management.

Whether you need a simple plug-and-play setup or a deep custom integration, we make connecting our powerful solutions straightforward so you can focus on what you do best.

Boost conversion by offering every payment method your customers trust and a streamlined, trustworthy experience that makes it easy for anyone, anywhere, to pay you.

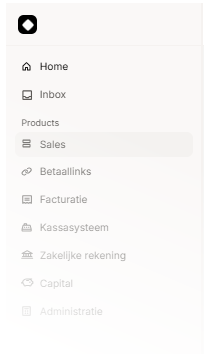

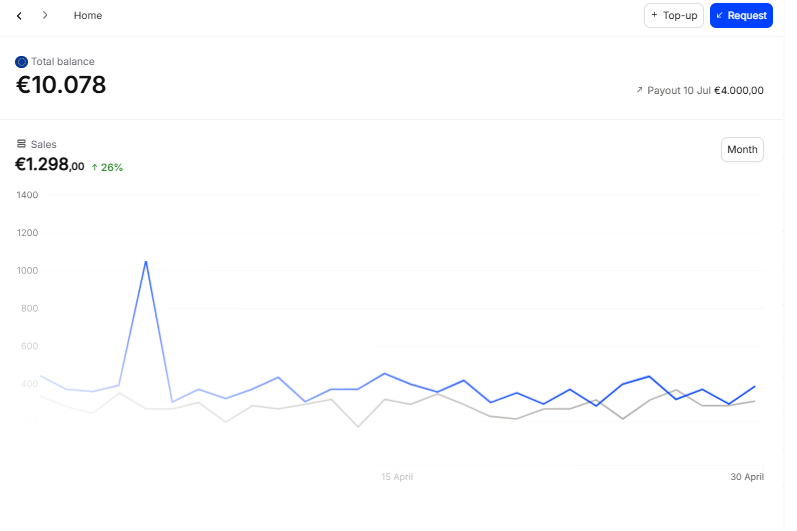

Get smart tools and clear insights to continuously enhance performance, safeguard revenue, and make every transaction work harder for your business.

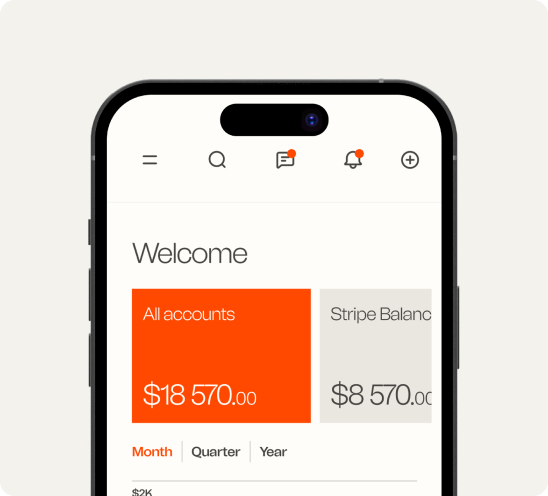

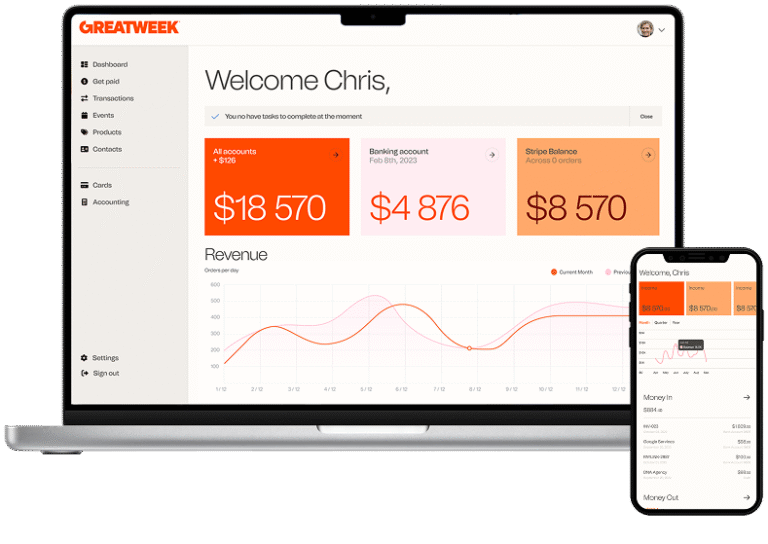

Mollie brings all your finances together into one central hub, giving you a crystal-clear view of your business, simplifying your admin, and putting you in complete control.

Boost sales, save time, and streamline every workflow with high-converting checkouts, payment links, invoicing, and subscriptions.

Create a high-converting payment experience tailored for your business and customers.

Create a payment link in seconds and share it via email, text, or social media. It’s the fastest, easiest way to sell without a website.

Build recurring revenue with easy automated billing, and keep it secure with smart tools that handle failed payments to cut customer churn.

Payment powered by Greatweek

Manage all your invoicing from one powerful dashboard: create and customise in minutes, track in seconds, and add a payment link for instant, one-click settlements.

Due 24 December 2026

Payment powered by Greatweek

Unify your online and in-person sales to get a single view of your payment data, simplifying reconciliation, cutting costs, and giving customers a consistent experience – wherever they buy.

No hidden fees, no lock-in contracts, no surprises. Just straightforward pricing that adapts to your business.

Perfect for growing businesses. You only ever pay for successful transactions – no minimum costs, no fixed contracts.

Processing over $50,000 a month? Get a custom pricing package with reduced rates, all tailored to your volume.

Selling products, services, or both? Online, in-store, or everywhere?

Our platform adapts to any business type, sector, and scale.

Big order and need a loan? Tired of typing IBANs for international payments? We’ve got you covered.

Get expense cards for your team and automate accounting with AI-powered expense management.

Offer and monetise payments with embeddable solutions to unlock new revenue for your platform.

Discover how Mollie helped optimise local payments.

Read the full storyDiscover how Mollie helped optimise local payments.

Read the full storyDiscover how Mollie helped optimise local payments.

Read the full storyDiscover how Mollie helped optimise local payments.

Read the full storyWhether you’re scaling at high volume, have complex integration needs, or want to explore custom pricing, we’re ready to help.

How Floid Scales with Greatweek Growth-Driven Payments

If your payment system creates more work than it solves, it’s time for a change. Discover the benefits of a unified omnichannel payments approach.

Boost conversion with optimised checkouts offering 40+ ways to pay, and drive revenue with recurring billing, invoicing, and payment links.

Greatweek is a technology provider, not a bank. Greatweek partners with Stripe Payments Company for money transmission services and account services with funds held at Evolve Bank & Trust, Member FDIC. When you sign up for a Greatweek account, you will also sign up for a Stripe Standard Connect Account. You may apply for various financial services within the platform and will need to agree to additional terms. Greatweek Visa® Commercial Credit Cards are issued by Celtic Bank. Neither Greatweek nor Stripe are FDIC-insured institutions. FDIC’s deposit insurance coverage only protects against the failure of an FDIC-insured depository institution. Stripe Treasury Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same type of account. The information provided on this website is not intended to offer, and should not be relied upon as, tax advice. You can review all our legal agreements and disclosures here.