In today’s fast-paced business environment, efficiency and flexibility are key to maintaining a competitive edge. For businesses of all sizes, one critical component of financial management is the invoicing process. Choosing the right invoicing tool can streamline operations, enhance cash flow, and improve customer satisfaction. At Greatweek.com, we understand the importance of selecting an invoicing tool that not only simplifies your billing processes but also offers flexible payment options like card payments. In this blog post, we’ll discuss the essential features to look for in an invoicing tool and why flexible payment options are crucial for your business.

The Essential Features of an Invoicing Tool

- User-Friendly Interface:

- An intuitive and user-friendly interface ensures that your team can quickly learn and effectively use the invoicing tool. This reduces training time and minimizes errors in the invoicing process.

- A well-designed interface also enhances the customer experience, making it easy for clients to understand and pay their invoices.

- Customizable Invoices:

- Every business has unique needs and branding requirements. The right invoicing tool should allow you to customize invoices with your logo, colors, and specific fields relevant to your industry.

- Customizable templates ensure that your invoices are professional and consistent with your brand image.

- Automated Reminders and Follow-Ups:

- Late payments can strain cash flow and disrupt business operations. Automated reminders and follow-ups help ensure that clients pay their invoices on time.

- These features save you the time and effort of manually tracking and chasing overdue payments.

- Detailed Reporting and Analytics:

- Comprehensive reporting and analytics capabilities provide insights into your invoicing and payment trends. This information is invaluable for managing cash flow, forecasting revenues, and making informed business decisions.

- Look for tools that offer customizable reports, enabling you to track key performance indicators (KPIs) specific to your business.

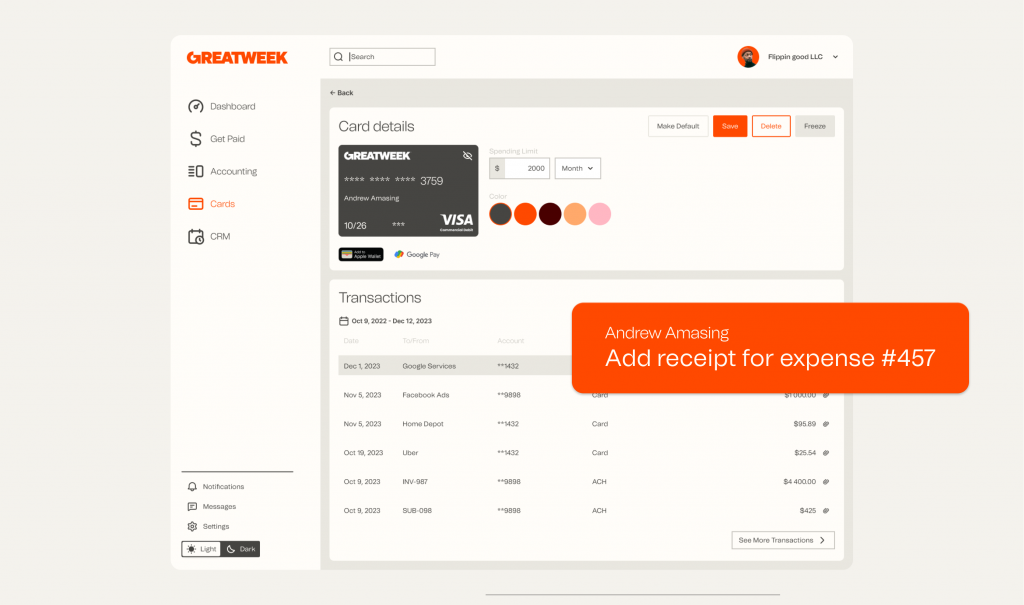

- Integration with Other Business Systems:

- Seamless integration with your existing accounting, CRM, and project management systems is essential for efficient operations. This ensures that data flows smoothly across different platforms, reducing the need for manual data entry and minimizing errors.

- Integration also enhances overall productivity by providing a unified view of your business’s financial health.

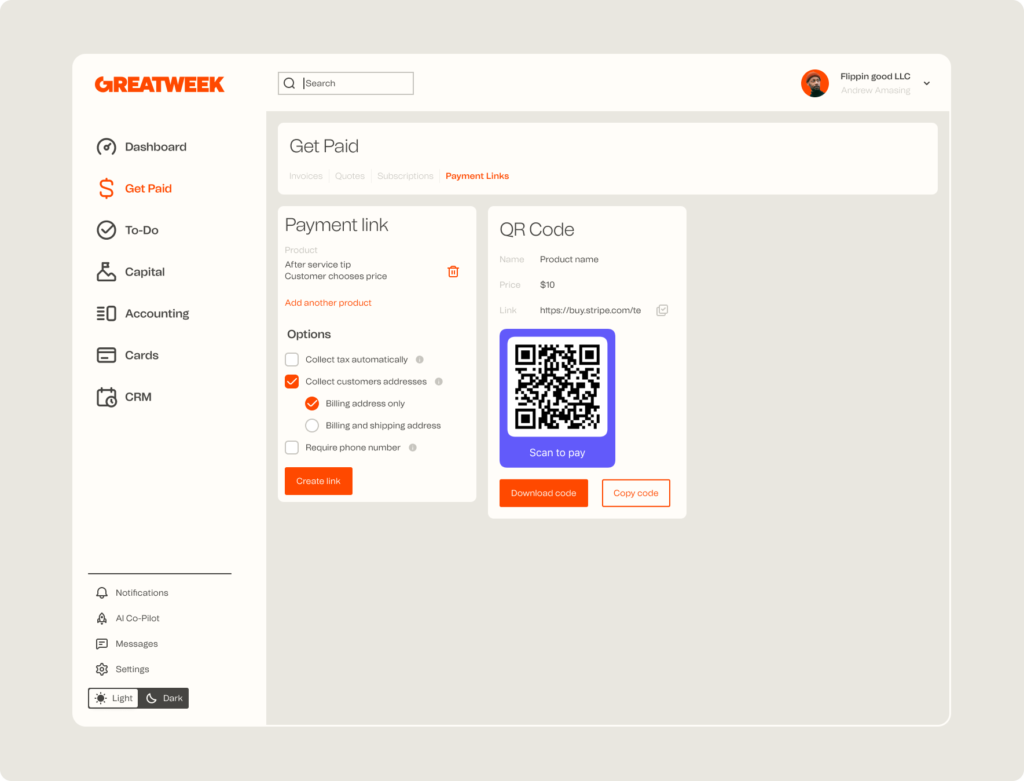

The Importance of Flexible Payment Options

- Enhanced Customer Convenience:

- Offering flexible payment options, such as credit and debit card payments, provides convenience to your customers. This can lead to quicker payments and improved customer satisfaction.

- Multiple payment options cater to diverse customer preferences, making it easier for them to settle their invoices promptly.

- Improved Cash Flow:

- Card payments are typically processed faster than traditional payment methods like checks or bank transfers. This speed can significantly enhance your cash flow, providing your business with the liquidity needed to operate smoothly.

- Faster payments also reduce the time spent on collections, allowing you to focus on core business activities.

- Security and Compliance:

- Reputable invoicing tools offer secure payment processing, ensuring that your customers’ payment information is protected. Compliance with industry standards and regulations, such as PCI DSS, is crucial for maintaining trust and avoiding potential legal issues.

- A secure payment system also reduces the risk of fraud and chargebacks, safeguarding your business’s financial integrity.

- Global Reach:

- For businesses that operate internationally, offering card payments and other flexible payment options is essential. This allows you to cater to a global customer base without the complexities of currency conversions and cross-border transactions.

- An invoicing tool with multi-currency support and international payment options can significantly expand your market reach.

Why Choose Greatweek.com

At Greatweek.com, we are dedicated to providing the best invoicing solutions tailored to your business needs. Our invoicing tool offers:

- Flexible Payment Options: Enable your customers to pay using credit and debit cards, ensuring quick and convenient transactions.

- Customizable Invoices: Create professional, branded invoices that reflect your business’s identity.

- Automated Features: Benefit from automated reminders and follow-ups to ensure timely payments.

- Detailed Analytics: Gain insights into your invoicing performance with robust reporting and analytics.

- Seamless Integration: Integrate effortlessly with your existing systems for a smooth workflow.

Choosing the right invoicing tool is a crucial step in optimizing your business operations and improving financial management. With the right features and flexible payment options, you can enhance customer satisfaction, ensure timely payments, and drive your business’s growth. Contact Greatweek.com today to learn more about how our invoicing solutions can empower your business and streamline your financial processes.