QuickBooks, while popular, might not suit every business due to its complexity, maintenance needs, and limited customization options. Exploring alternatives tailored to your specific needs could lead to better outcomes.

While QuickBooks is a popular and widely used accounting software, there are several reasons why business owners may consider looking for an alternative:

Customer support and updates: QuickBooks has a large user base, which can sometimes lead to delays in customer support responses or slower updates and improvements. Business owners may prefer alternatives that offer robust customer support, regular updates, and actively listen to user feedback to enhance their software’s functionality and address issues promptly.streamline your financial processes.

Cost: QuickBooks can be expensive, especially for small businesses or startups with limited budgets. The software has different pricing tiers, and as businesses grow and require more features, the costs can increase significantly. Exploring alternative software options might provide more cost-effective solutions.

Complexity: QuickBooks, particularly the desktop version, can be complex and overwhelming for users who are not well-versed in accounting. The software may have more features than necessary for some businesses, leading to a steeper learning curve. Alternatives with simpler interfaces and streamlined functionality might be more user-friendly and easier to navigate.

Industry-specific needs: Different businesses have unique accounting requirements based on their industry. QuickBooks may not always offer industry-specific features or integrations that cater to specialized needs. Business owners should consider alternatives that specifically address their industry’s accounting demands, providing relevant tools and functionalities.

Scalability: As businesses grow, their accounting needs evolve as well. QuickBooks may have limitations in terms of scalability and may not adequately support the increasing complexity of a growing business. Exploring alternative software that can seamlessly accommodate expansion and provide scalability options can be beneficial in the long run.

Integration capabilities: Some businesses rely on other software systems, such as CRM (Customer Relationship Management) or inventory management tools, to streamline their operations. QuickBooks may not always integrate smoothly with these third-party applications, causing inefficiencies and manual workarounds. Business owners should consider alternative software options that offer better integration capabilities with their existing systems.

Cost: QuickBooks can be expensive, especially for small businesses or startups with limited budgets. The software has different pricing tiers, and as businesses grow and require more features, the costs can increase significantly. Exploring alternative software options might provide more cost-effective solutions.

Complexity: QuickBooks, particularly the desktop version, can be complex and overwhelming for users who are not well-versed in accounting. The software may have more features than necessary for some businesses, leading to a steeper learning curve. Alternatives with simpler interfaces and streamlined functionality might be more user-friendly and easier to navigate.

Industry-specific needs: Different businesses have unique accounting requirements based on their industry. QuickBooks may not always offer industry-specific features or integrations that cater to specialized needs. Business owners should consider alternatives that specifically address their industry’s accounting demands, providing relevant tools and functionalities.

Scalability: As businesses grow, their accounting needs evolve as well. QuickBooks may have limitations in terms of scalability and may not adequately support the increasing complexity of a growing business. Exploring alternative software that can seamlessly accommodate expansion and provide scalability options can be beneficial in the long run.

Integration capabilities: Some businesses rely on other software systems, such as CRM (Customer Relationship Management) or inventory management tools, to streamline their operations. QuickBooks may not always integrate smoothly with these third-party applications, causing inefficiencies and manual workarounds. Business owners should consider alternative software options that offer better integration capabilities with their existing systems.

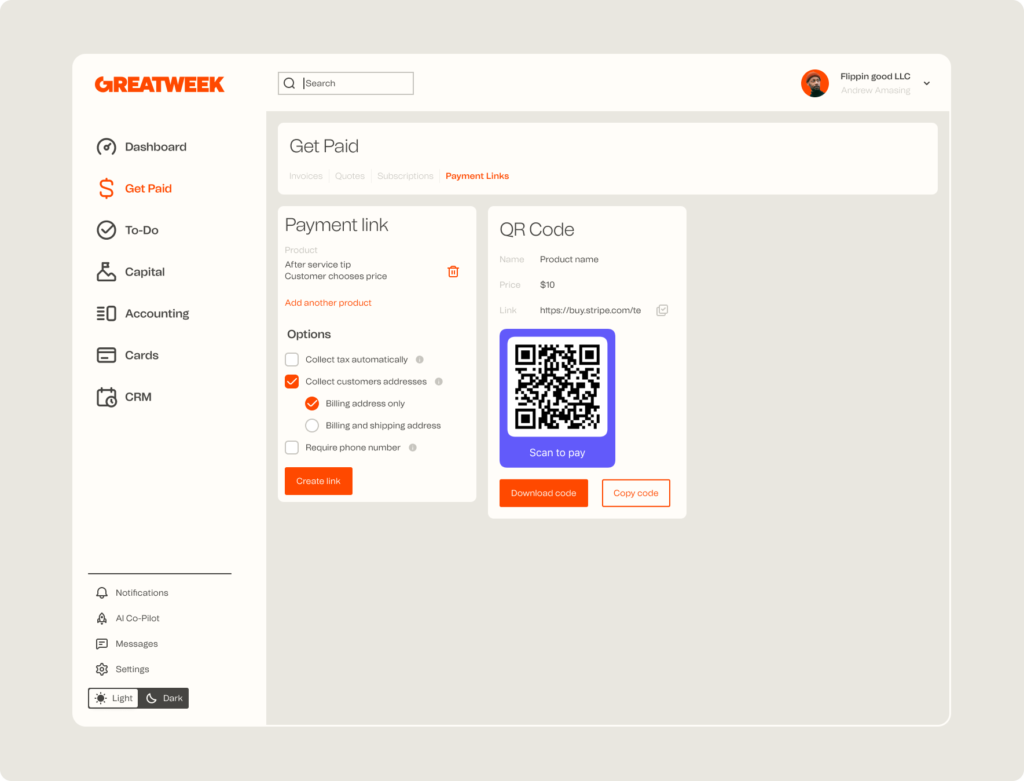

Get paid in a few clicks

Send invoices or start subscriptions. Your customers can pay you with any method, including cards.

Ultimately, the decision to look for an alternative to QuickBooks should be based on individual business needs, preferences, and budget. It’s important to thoroughly research and evaluate different software options to find the best fit that aligns with your specific requirements and helps streamline your accounting processes effectively.

Instead of Quickbooks – give Greatweek.com a try. We sync up existing quickbooks transactions for you, or we can set you up fresh in Greatweek straight away.

Ultimately, the decision to look for an alternative to QuickBooks should be based on individual business needs, preferences, and budget. It’s important to thoroughly research and evaluate different software options to find the best fit that aligns with your specific requirements and helps streamline your accounting processes effectively.

Instead of Quickbooks – give Greatweek.com a try. We sync up existing quickbooks transactions for you, or we can set you up fresh in Greatweek straight away.