Working capital that just works

Understanding eligibility. Eligibility is based on a combination of factors, including overall sales volume and history with Stripe. Eligible businesses will automatically receive an email if they qualify for an offer. If you also process payments outside of Stripe, you can connect external accounts or move more volume onto Stripe which may improve your eligibility.

Get funding fast. If your application is approved, you’ll see the funds in your bank account typically as soon as 2 business days. To make sure funds are disbursed successfully, you must set a valid bank account as your primary payout method.

Pay one fixed fee. The total amount you owe is the loan amount plus one fixed fee, paid back over time through your sales. There is no compounding interest, early repayment fee, or late fee.

Repay automatically. Stripe deducts a percentage of each sale until the total amount owed is repaid. You’ll have a minimum amount due each repayment period, and if the total amount you repay through sales doesn’t meet the minimum, your account will automatically be debited the remaining amount at the end of the period.

How it works

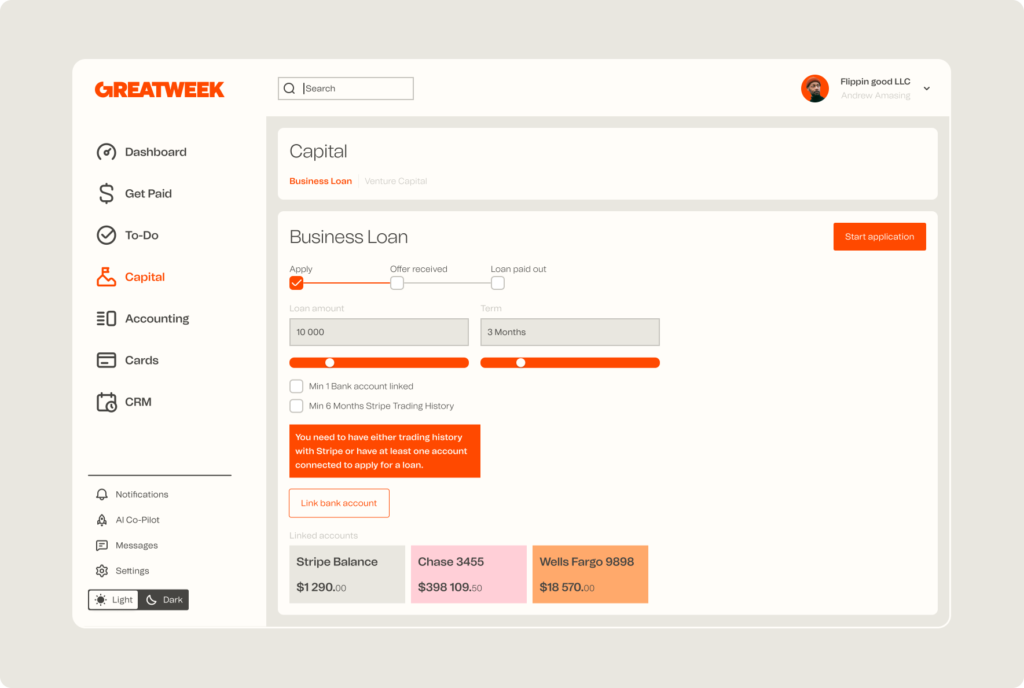

Sync your bank account(s) to the Greatweek platform and contact us to start the application. You’ll get an answer the same day.

If approved you can view the offer in your dashboard. Select the amount that’s right for your business needs. The fee and repayment rate are set based on the accepted amount.

After your selection is reviewed, if you are approved the funds will be deposited into your bank account, typically the next business day.

You’ll automatically repay the loan with a fixed percentage of your daily sales until the total amount is repaid.

Loans are issued by Celtic Bank and powered by Stripe. All loans subject to credit approval.

Ready to get started?

Greatweek Capital program is in Beta. We will evaluate your application based on factors that include payment volume, business model, and history. It costs nothing to apply and we promise quick decision making.