Small business owners are often hustling to keep up with their tasks and responsibilities. It is tough to be productive and accountable when you have so much on your plate.

Here are some tips for helping small businesses optimize productivity:

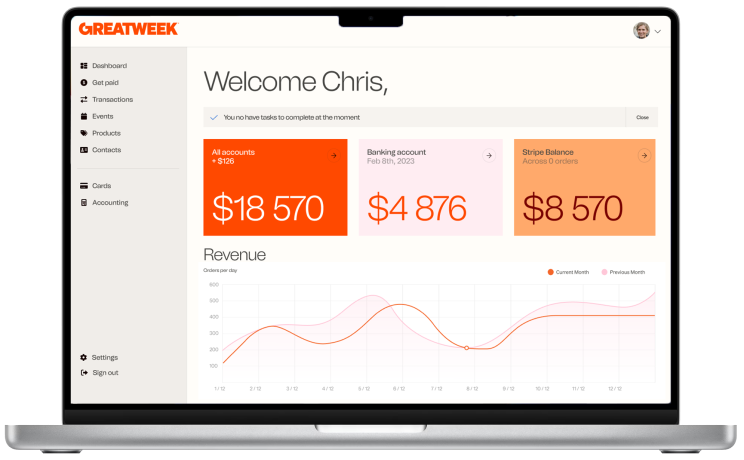

- Automate as much as possible. Use technology to your advantage, especially when it comes down to automating tasks that can be done manually. For example, if you use accounting software like Great Week, there is no need for you to enter transactions manually by hand. The software does all of the work for you! It will even send reminders for upcoming deadlines and payments due so that you don’t forget anything important. This will allow you to spend more time focusing on other aspects of your business instead of having to remember every single thing that needs doing.

- Set goals and track progress towards them. It’s important that you set goals for yourself in order to stay motivated and accountable throughout the year! You should also monitor how well your business is performing and make adjustments accordingly based on what kind of results you are getting from certain strategies or tactics.

Boost your productivity and revenue with Great Week!

There are many benefits to using small business accounting software.

One of the most important is that it can help you increase revenue by giving you a better view of all aspects of your business. When you know where your money is going, you can make more informed decisions about how to use it more efficiently.

Another benefit is that it helps you keep track of inventory and other assets, which is important for businesses with large inventories or multiple locations.

If you’re thinking about switching to an accounting software program, here are some things to consider:

The type of data that’s required by your industry – Some industries require more specific data than others, so if yours is one of them, make sure the software has what you need.

How much data needs to be tracked – If there’s a lot of data involved in your business (such as sales tax), then look for programs that offer extensive reporting capabilities so that you don’t have to spend time creating charts yourself or hiring someone else to do it for you.

Above shot of handsome asian man sitting in his office, eating salad, holding some papers and looking at camera.